virginia state ev tax credit

To begin the federal government is offering several tax incentives for drivers of EVs. 1 hour agoThe push for electric vehicles as a cleaner alternative to gasoline-powered vehicles has led to some pointing out that much of the nations electric grid is powered by fossil fuels.

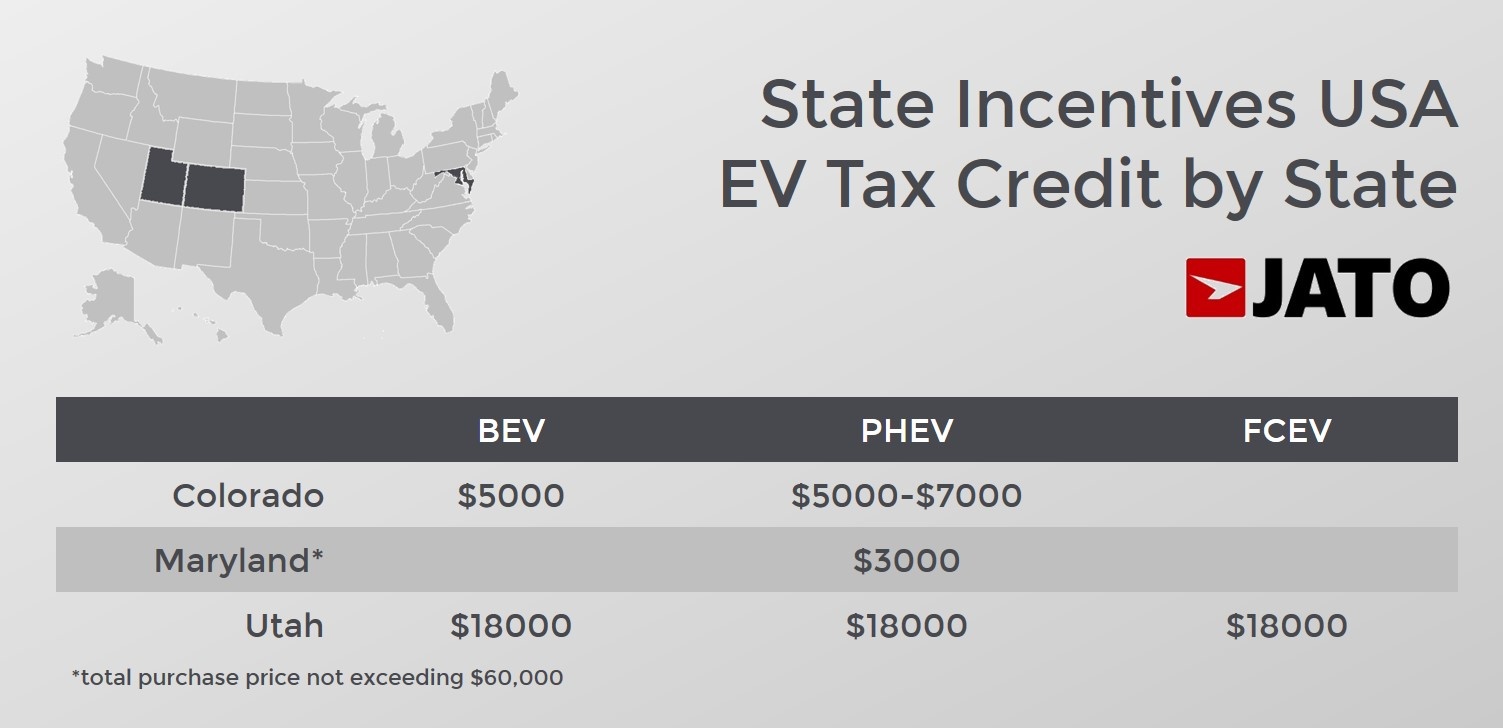

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

The Fund shall be established on the books of the Comptroller.

. The West Virginia Democrat who previously described federal tax credits for EVs as ludicrous announced a surprise deal with Senate Majority Leader Chuck Schumer on a reconciliation package. Beginning September 1 2021 a qualified resident of the Commonwealth who is the purchaser of a new. For every kilowatt-hour of capacity above 5 kilowatt-hours the credit goes up by 417 capping out at 7500.

Free means free and IRS e-file is included. How Much Is the EV Tax Credit Worth. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle.

Discuss evolving technology new entrants charging infrastructure government policy. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. Energy Information Administration estimates that in 2020 88 of West Virginias grid was powered by coal whereas renewable energy resources.

Ad All Major Tax Situations Are Supported for Free. Driving an electric car now comes with added benefits for driving a clean car. The Virginia State Corporation Commission may not set the rates charges or fees for retail EV charging services provided by non-utilities.

There is hereby created in the state treasury a special nonreverting fund to be known as the Electric Vehicle Rebate Program Fund. In its final form the program which would begin Jan. Reference Virginia Code 101-130704 Electric Vehicle EV Fee.

In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Max refund is guaranteed and 100 accurate.

Check that your vehicle made the list of qualifying clean fuel vehicles. Light duty passenger vehicle. First the amount you receive will depend upon your vehicle.

Ad Here are some of the tax incentives you can expect if you own an EV car. Virginias National Electric Vehicle Infrastructure NEVI Planning. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery.

Federal and State Electric Car Tax Credits Incentives Rebates. Reference House Bill 443 2022 and Virginia Code 56-121 and 56-23221 Public Entity Retail Electric Vehicle EV Infrastructure Authorization. If the purchaser of an EV has an income that doesnt exceed 300 percent of the federal poverty level they can get an extra 2000 on their.

Start Your Tax Return Today. Effective October 1 2021 until January 1 2027 Electric Vehicle Rebate Program Fund. An earlier version of the budget passed by the.

A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund. If you go with an all-electric vehicle the odds are higher that youll.

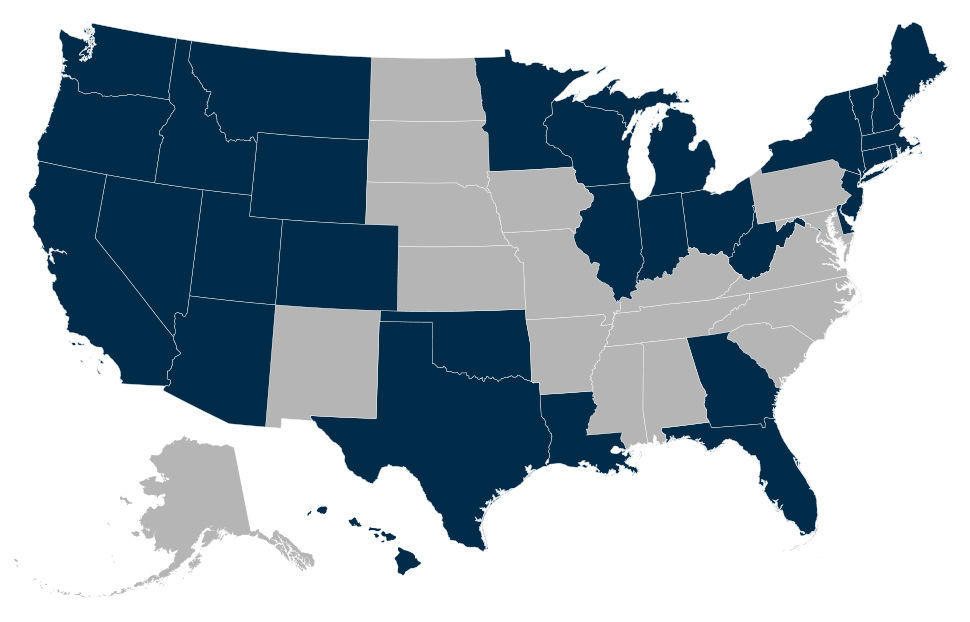

The incentives may vary by sector but in general there are programs for all types. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Reference House Bill 443 2022 and Virginia Code 56-121 and 56-23221.

If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Heavy duty electric truck. However the credit is worth up to 7500 depending on the size of the battery.

DMV Registration Work Center. This is the Reddit community for EV owners and enthusiasts. Light duty electric truck.

Medium duty electric truck. However you should be aware of the following requirements. Cars need to be under 55000.

Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number.

This page lists grants rebates tax credits tax deductions and utility incentives available to encourage the adoption of energy efficiency measures and renewable or alternative energy. Either fax your application to 804 367-6379 or mail it to. Federal Tax Credit.

Federal and State Electric Car Tax Credits Incentives Rebates. The Virginia State Corporation Commission may not set the rates charges or fees for retail EV charging services provided by non-utilities. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles.

Residential customers small and large businesses and government agencies.

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Crowning An Energy Champion Among U S Colleges Universities March Madness Style Chester Energy An Colleges And Universities March Madness Systems Biology

Jack Link S Manufacturing Facility Bringing 800 Jobs To Georgia

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Maryland Map Maryland Greetings

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns

Electric Vehicle Incentives By State Polaris Commercial

Boehringer Ingelheim Animal Health Plans 57m Expansion In Georgia

Biden S Electric Vehicle Plan Faces Jam From Cultural Divide 2022 02 03 Supplychainbrain

1986 Or 1988 Or 1991 Or 1992 Or 1993 American Silver Eagle 1 Etsy Silver Eagle Coins American Silver Eagle Silver Eagles